Long-Term Care (LTC)

Long-term care insurance can help manage healthcare costs and reduce the impact of inflation while ensuring that your healthcare needs, and those of your loved ones, are covered well into the future.

Long-term care insurance can help:

- Pay for the care you need when you can no longer care for yourself

- Preserve your independence and dignity

- Allow you to remain in your home while receiving the quality and level of care you require

- Protect your hard earned nest egg, family’s financial future and your legacy

- Safeguard you from threats to health and safety due to severe cognitive impairment

When planning for long-term healthcare needs, it’s important to keep in mind that:

- Medicare is not nursing home insurance and does not cover long-term care

- Private medical insurance or Medicare supplement plans do not cover maintenance care

- Long-term care is a range of services and supports you may need to meet your personal care needs. Most long-term care is not medical care, but rather assistance with the basic personal tasks of everyday life, sometimes called Activities of Daily Living (ADLs), such as:

- Bathing

- Dressing

- Using the toilet

- Transferring (to or from bed or chair)

- Caring for incontinence

- Eating

Other common long-term care services and supports are assistance with everyday tasks, sometimes called Instrumental Activities of Daily Living (IADLs) including:

- Housework

- Managing money

- Taking medication

- Preparing and cleaning up after meals

- Shopping for groceries or clothes

- Using the telephone or other communication devices

- Caring for pets

- Responding to emergency alerts such as fire alarms

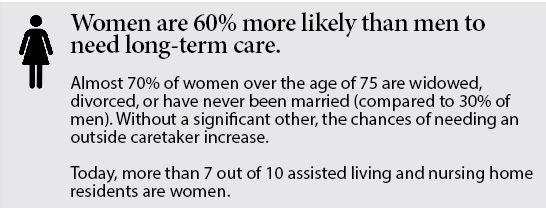

Three out of four caregivers work a paying job while simultaneously caring for their loved one. Often, they have to make accommodations such as cutting back hours or quitting altogether, which can have large financial implications on their future. Loss of earnings, Social Security benefits, job security, career mobility, health insurance and retirement savings are just a few examples of the sacrifices caregivers often have to make.

While many affluent investors can afford to self-insure, transferring the risk to the insurance company and preserving assets for future generations is a stronger long-term investment strategy.

A long-term care insurance policy makes it easy for you to access the best type of care, and it can help to give your family peace-of-mind and the ability to focus on your well-being. In our experience, when there is no long-term care policy to rely on, the plan of care chosen is typically the most inexpensive which may not provide you with the level of care that you need. Often, the healthy spouse has concerns of running out of money and there may be a need or desire to protect assets for future generations.

You have options. Long-term care policies come in all shapes and sizes and we can help you identify the one that is right for you. There are also ways to access long-term care protection with a life insurance or an annuity product, also known as hybrid policies, which may better fit your needs than a stand-alone long-term care policy.

Let’s discuss the options that are most appropriate for you.

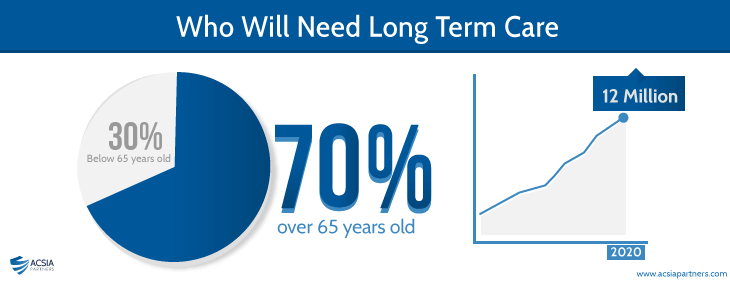

About 70% of Americans over the age of 65 will need long-term care services during their lifetime. By 2020, this number is expected to exceed 12 million.

Prudential Research Report: Long Term Care Cost Study, 2010